Yes, I know that is a clickbait headline, but a modified version would probably be “The least exciting and sexy way to become a Multi-Millionaire – Guaranteed”. Becoming a millionaire is actually quite simple. It’s nothing more than a basic math problem that requires two things: time and discipline. You don’t need to earn a ton of money to get started. Building wealth is like planting a tree – “The best time to plant a tree was 20 years ago, the next best time is now” – Chinese Proverb. The combination of time and discipline is the secret to becoming a millionaire.

If you are under 30 (or even 20!), this is one of the most important things you will ever read. The sooner you start investing, the more the magic of compounding interest will work in your favor.

Compounding Interest

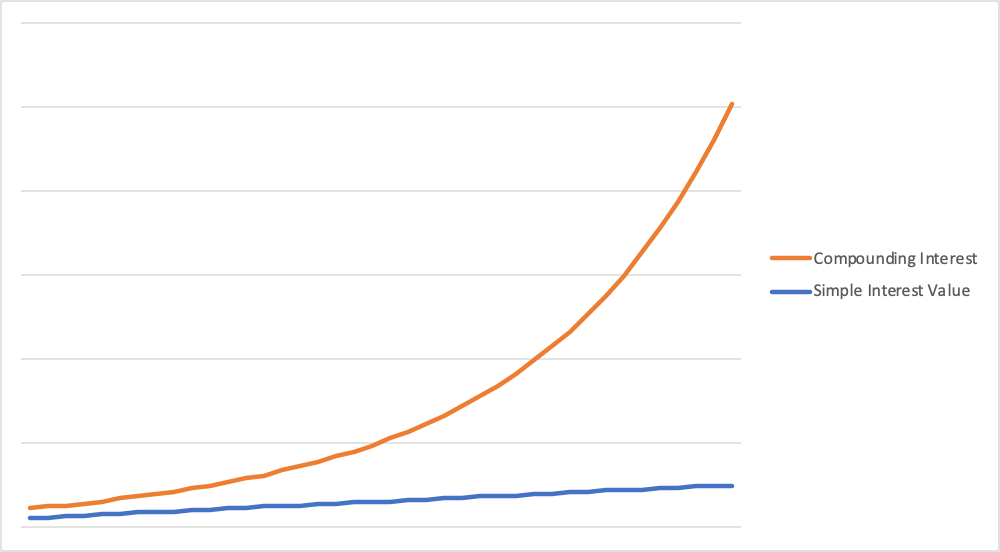

What is compounding interest? It’s what creates the exponential growth chart above and really the special sauce when talking about growing wealth. It is basically the concept of earning interest on your interest. For example, if you earn 5% interest on a 5 year bond worth $1,000 that is compounding annually that means you will be granted the interest after the first year of $50, but you don’t get the money out – it adds to your investment. The good news is that it’s the new basis for next years’ interest, so your next interest payment will be ($1,050*0.05=52.5) which brings your new balance to $1,102.5, and over the course of the five years you will end up with $1,276 vs. $1,250 with just simple interest (just getting an annual $50 interest payment and your principal back at the end)

This example may seem small, but as you start to use longer time horizons you see it really have an impact. In the chart below, you will notice that over 30 years of the same example, you would have $1,822 more using compounding interest than simple interest. It is a snowball effect known as exponential growth!

| Years | Compounding Interest | Simple Interest | Difference |

| 5 | $1,276 | $1,250 | $26 |

| 10 | $1,629 | $1,500 | $129 |

| 15 | $2,079 | $1,750 | $329 |

| 20 | $2,653 | $2,000 | $653 |

| 25 | $3,386 | $2,250 | $1,136 |

| 30 | $4,322 | $2,500 | $1,822 |

The Rule of 70 (or 72)

You don’t want to get me started talking about how beautiful powerful exponential growth is. But what you need to know is that it allows us to take modest contributions and turn them into a fortune! One tool you can use to let your imagine start running wild is what we call the rule of 70 (some people use 72 – its an approximation so use either one). The rule of 70 is basically that you can divide 70 by your anticipated (compounding) rate of return, which will tell you how many years it will take your investment to double!

If we used the above example of $1,000 at 5%, you can take 70/5=14 years. You can see in the table above at 15 years we had over doubled the initial $1k investment. The best part is that you just added a layer to the snowball, which will double again in another 14 year (from $2k to $4k).

So to recap that – your investment is accelerating in value over time. It takes you 14 years to get $1k in interest, then just over 7 years past that you get another $1k of interest. What happens is that over time your initial investment is dwarfed by the compounded interest – which is why you don’t need a huge $ investment if time is on your side.

How to apply it to your ‘wealth accumulation’ plan

Side note- I don’t like the term ‘retirement’ because it sounds like an exit strategy. Financial independence and wealth accumulation are worthy goals whether you want to work a traditional job and have a traditional lifestyle or want to support a long term alternative lifestyle like sailing the world.

I’m not the first person to suggest you should be setting aside at least 10% of your gross earnings toward ‘retirement’. I created a super simple interactive spreadsheet you can use to see what your specific scenario would look like. The point of this spreadsheet is to illustrate the long-term view of how these variables impact the future. A few notes to get you started:

- Rate of return – I recommend sticking to market index funds (like the Vanguard S&P 500). They have extremely low expense ratios and consistently beat the so called ‘pro stock pickers’ over the long run. I have it set at 9% to start with. Why? over the last 90 years the S&P 500 has averaged 9.8%. Averages aren’t perfect predictors of the future, but it’s the best we have.

- In the spreadsheet, you can fill in the yellow boxes, everything else will automatically populate

- Be aware of your time horizon. If you are 40 years old you have a different time horizon (years left until retirement) than a 20 year old

- If you’ve played around with the tool for a bit, try deleting all contributions after year 15. Did you notice anything? Your ending balance really doesn’t drop that much. That is because at this point, your snowball is already greatly outpacing your annual contributions. You planted the tree 15 years ago, and it’s got its own roots now so it can grow without watering it.

- You can also do the opposite, and ‘delay’ saving for the first ten years. How much does your balance drop then?

- These are examples the of time value of money – we’ll get into that in a different post though

Below is the Excel spreadsheet I made to illustrate this. It’s a simple, but powerful calculator to estimate wealth accumulation over a long term:

Setting Goals & Milestones

There are two more profound milestones I want to point out. This is because even though I intellectually understood them, it took me to actually achieve them to realize their power. There is a point where your annual growth from capital gains is greater than the contributions you made that year. This is a big psychological win as you will realize your account really has legs of its own now. The second is when your annual capital gains exceeds your annual salary – I am not there yet, but I see that as another profound milestone. If you look at the spreadsheet, you should be able to see both of those points.

You will find that, if you have time, it doesn’t take any crazy assumptions to end up with a multi-million dollar net worth. I get it – this is not the sexy get rich quick scheme you may have been hoping for. It’s really the “build wealth slow method”. Remember that wealth that is acquired quickly is often disposed of just as quickly. Just read the statistics on lottery winners and recipients of large inheritances.

Time is much more valuable than money. I’ll let that sink in for you to digest as a much more philosophical statement than just wealth accumulation. How are you planning your life around the time you have left? Whether it’s 100 years of 20 years, we all have a finite amount of time-wealth left, and even less of it in our ‘youth’.

Wealth accumulation isn’t a goal in itself, financial freedom is what that wealth buys you. You will need to make sacrifices in the short term so you can earn your freedom in the long term. It’s incredibly simple, but not always easy. Otherwise everyone would be a millionaire.

Getting Started

I learned in High School that the sooner you get the ball rolling (investing early), the more times you will ‘double up’ your net worth. When I started investing at the age of 16, I needed to first convince my parents to help me open a custodial account since I was under 18. I also started investing in 2007 right before the great recession hit (a good time for a lesson, not the best time to go all-in on a REIT…) I always looked at my early investing as a way to guarantee myself a modest, comfortable retirement. Over the years, my goals have changed, but the strategy has been steady. I no longer consider it a ‘retirement’ plan, but a ‘wealth accumulation’ plan.

The point is you need to get started – right now. Open a brokerage account if you don’t have one already. I use E*Trade, but there are a lot of newer brokerage firms like Robinhood, Cashapp, etc. that you can easily get started.

**Before you go too far on brokerage accounts, you need a tax strategy. There are tax-advantaged accounts like a 401(k), 403( b), Roth IRA, Traditional IRA. Or if you want to be able to touch it before retirement age you can get a normal brokerage account. I think a good strategy involves both. I’ll go into the options in another post, but you should understand your tax goals and strategy for this account.

Step by Step

- Open a brokerage account (or increase contribution of your tax-advantaged account)

- Fund the account with money you have available – whether it’s $100 or $50k

- Start with index funds like the Vanguard S&P 500 ETF (VOO). Don’t get distracted by individual stocks or cryptocurrency until you have a diversified base to start from

- Set up automatic deposits and automatic investing in the fund you choose, have it automatically invest

- Reinvest dividends

- Continue for 30-50 years

Recommended Books & Resources

Books and Resources to cultivate your financial mindset:

- The Millionaire Next Door – Thomas Stanley

- The Richest Man in Babylon – George S. Clason

- The Investing Tutor – Dr. Hans (Instagram/Podcast/blog)

- Follow investing accounts on Instagram – it’s a good way to surround yourself with constant positive reinforcement and new knowledge

What do you think about the secret to becoming a millionaire? It’s simple but powerful. Do you have the discipline it takes to gain your freedom? Leave a comment below!